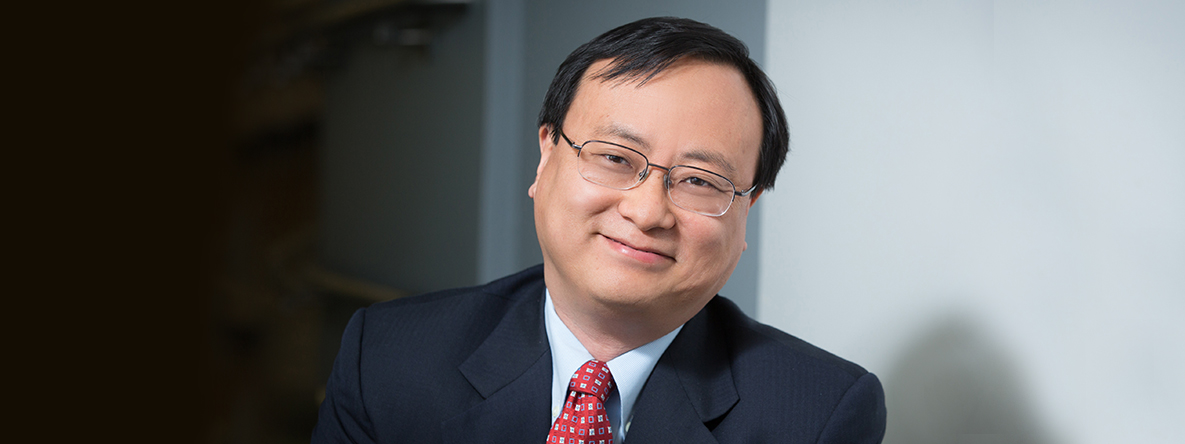

Bin Zhou

-

principal

-

Boston

Dr. Zhou is a valuation, corporate finance, and accounting expert with more than 25 years of consulting experience.

He specializes in the application of financial economics, management accounting, business organizations, and taxation principles to various consulting and litigation settings. Dr. Zhou’s work has included projects spanning financial institutions, the consumer goods, energy, pharmaceuticals and medical devices, technology, and utilities industries.

Dr. Zhou has supported testifying experts and led large engagement teams in many high-profile transfer pricing, bankruptcy, and securities litigations. His work has been primarily focused on the economic analysis of transfer pricing disputes involving hard-to-value intangibles, the economic substance of complex transactions, solvency analysis and fraudulent conveyance claims, structured finance transactions, financial statement analyses, and damages.

His recent experience includes claim estimations in the Puerto Rico Electric Power Authority’s Title III case, lost profits damages in an antitrust case against a large technology company, and a Delaware breach of fiducial duty class action against Michael Dell. He has also recently performed economic profitability analyses in several antitrust matters and has been involved in a special litigation committee investigation of a large acquisition in the software-as-a-service industry, international arbitration cases involving the valuation of publicly listed Korean companies, and intellectual property transfers in distressed companies.

Brandeis University

PhD in International Economics and Finance

Washington State University

MA in Economics

Fudan University (China)

BA in Economics

Personal Interests

Bin is a member of a number of professional associations, including the American Economic Association, the American Finance Association, the Western Finance Association, and the National Association for Business Economics.

Testimony

Before the FERC, Docket No. ER26-455, Affidavit of Dr. Samuel A. Newell, Dr. Andrew W. Thompson, Dr. Bin Zho, and Joshua C. Junge Regarding Updates to PJM’s CONE and Net Energy and Ancillary Service Offset Parameters for Delivery Years 2028/29 Through 2031/32.